4.4x Engagement Through UX Strategy

Quantamize

The Mission

Quantamize was well positioned in the market with a strong mission statement and a disruptive business model; however, the clunky user experience was quickly causing the start-up to lose traction in the market space. The users expressed frustration with the overall product experience citing it hard to navigate while the design cheapened the Quantamize brand. The Mission Disrupt team would be tasked with turning around the platform, implementing a design that would increase product trust, conversion rate & overall platform engagement.

Services

UX / UI Design, Web Design, Web Development

Optimizing the Investor Experience for Quantamize

-

Conversion Rate Optimization

To identify the root cause of the user experience issues Quantamize faced our team deployed Hotjar, a piece of software that allowed our team to see what quantamize users were seeing when they browsed the site. We used heatmaps to visualize where users clicked, moved and scrolled on the site, we deployed screen recordings that showed how users navigated the site uncovered obstacles that caused confusion, finally we used surveys to understand what features would make the product better.

-

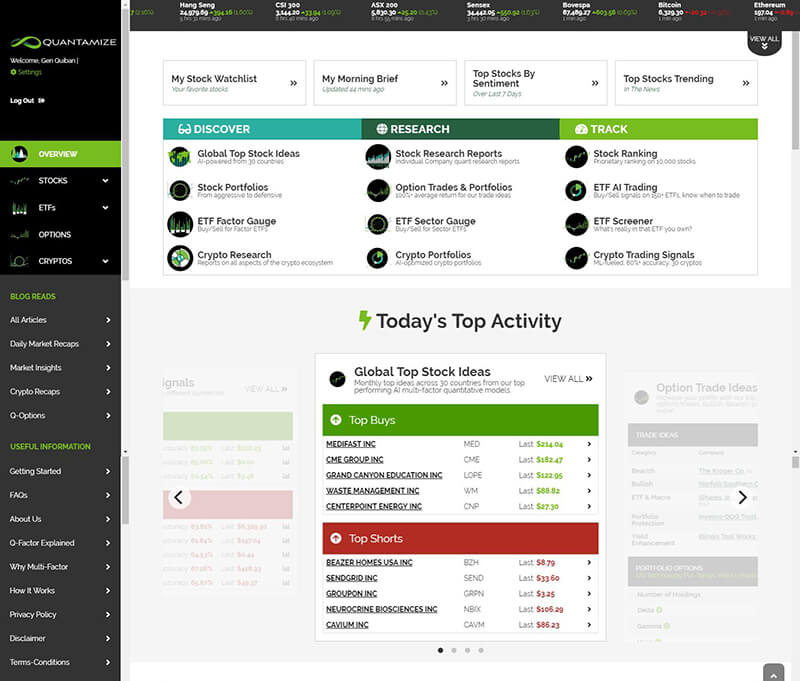

Discover, Research, Track

At its core, Quantamize looks to empower investors with the ability to discover their next big investment with quantitative research. Keeping this in mind we centered the design around discoverability, with intuitive modules that highlighted research opportunities in a buy/sell matter. By carefully segmenting the products we also made it easier to find research relevant to that user. Lastly the ability to track research through an easy “Add To Watchlist” button on many of the dashboard pages makes it easy to follow the progress of an investment opportunity.

Driving Engagement Through UX Innovation and Strategic Media

-

Innovative Investment Modules

Each module featured within the dashboard required a balance of what both amateurs and veteran investors looked for when evaluating investment opportunities. The dashboard modules allowed for investment information to be read in a quick & digestible manner but also appealed to information junkies by allowing a user to easily dive into detailed investment information.

-

Streamlined Navigations

One of the largest issues we encountered in the old Quantamize design was the ability to find information and quickly navigate throughout the platform. By incorporating a static sidebar menu design, users now had the ability to access any product with just a few clicks. The addition of breadcrumbs allowed users to go to visit previous pages with ease, while not having to restart their search. Finally, by adding an expandable stock ticker at the top of each page, users could easily benchmark any investment opportunity against major global index.

-

Influencer & Paid Media Strategy

Our team, structured partnerships with influencer podcasts and thought leader publishers, to create content that informed individual investors while growing Quantamize’s brand credibility. Our team coordinated research, media buys & supervised content production. The series of sponsorships & content pieces results in high-converting traffic to the website.

You're Not Alone, Here's What Our Clients Are Saying

Increase in converson

Increase in 28 day active users

Increase in returning users

Acquistion by Forbes in 2019

The Outcome

Mission Disrupt was hired with the understanding that we would increase bottom-line performance for the company, here’s how we stacked up In the last three months compared to the three-month prior to launching our newly revamped dashboard UI.

- 362.36% Increase in conversion

- 436.36% Increase in 28 day active users

- 344.71% Increase In returning users

- 8%-15% Conversion Rate

- Acquired By Forbes In December 2019

After Launching The new design for the Quantamize Platform Has Been Featured In:

CNBC

Benzinga

Bloomberg

The Wall Street Journal

You might be interested

Cabinet Direct

A Custom WordPress Website with Netsuite Integration

Henry Schein Dental Practice Transitions

Modern Design Meets Function: A Scalable Website Built for the Dental Transitions Market

MB Stone Professional

Driving Increased Revenue Through a Better-Organized Design